Luxury rules

The rules luxury brands live by to create and maintain their lustre

Whenever I work on luxury products, I’m always struck by how different they are from the premium or mass markets. And, as a consequence, how differently companies extending into luxury have to act from their business-as-usual.

The Luxe sector has its own dynamic

With dark economic clouds overhead, it might seem like an odd time to consider the luxury market, but it runs by different rules to the wider economy. Over the last three years, while others struggled with soaring inflation and interest rates, the luxury sector chalked up 20 per cent growth rates. During Covid the rich get a lot richer and the merely well-off piled up their savings, then when lockdowns were lifted many of the well-heeled indulged in a prolonged bout of ‘revenge shopping’. One result of this boom is that Bernard Arnault, CEO of LVMH, the largest luxury group in the world. He now jostles with Elon Musk for the title of richest man in the world.

While the 20% annual growth rates the industry has enjoyed over the last three years are unlikely to return anytime soon, the market is still growing at around the rate of inflation. Growing wealth inequalities also mean that there will continue to be a substantial affluent market to target.

Two critical shifts are also underway. First, the US has overtaken China as the biggest luxury market. For the last decade, roughly a third of luxury spending came from Chinese consumers, and their tastes drove the market. But as this growth engine of the global economy has faulted, so has its lavish consumption. In 2023, the US accounted for 30% of luxury sales, with China and Europe making up just over 20% each.

The second shift is towards Quiet luxury –formerly known as Stealth wealth. The last two decades have been defined by the tastes of aspirational Chinese and Millennial consumers in search of bling and bold logos. But since Covid, economic woes and the rising sophistication of newer luxury consumers, there is more demand for less dominant logos and a greater emphasis on quality and longevity.

So, in a sluggish economy, you can see what many companies find attractive about the luxury market’s glamour, perceived high margins and decent growth rates.

Luxury is different

On the face of it, luxury products and services sit on the top price tier for many categories, with ‘premium’ in the middle and budget or ‘mass’ at the bottom. But there’s more to entering the luxury market than using higher quality materials and charging top dollar.

So, what do we mean by luxury? Let’s start with the key categories, with cars, personal goods (handbags, watches and clothes) and hospitality (including hotels) being the biggest.

Luxury is subjective. Its meaning varies over time, place, product category and person, but it always involves high-value purchases wrapped in an alluring experience that confers social prestige. With cars and personal goods in mind, the table below presents some useful generalisations about how luxury differs from the premium business.

Premium vs Luxury characteristics

Exclusivity, retail and personal service mark luxe brands apart.

Nine rules

How do luxury brands achieve and maintain their lustre? Here are nine rules they live by:

1. Manufacture meaning

Create an authentic and alluring brand essence

The foundational rule is about how luxury brands manufacture meaning for people. Much more than premium brands, luxury ones devote enormous efforts to polishing and re-polishing their brand essence, underlining its authenticity and enigmatic allure. This evocative ambience of glamour provides consumers with a reason to believe in the brand and the critical justification to pay sometimes 20 or 30 times more than the mass market alternative. All the other rules are founded on and guided by this essence.

Luxury brands often combine two or more of these sources of meaning:

2. Tell evocative stories

Reinforce the brand essence with captivating narratives

Luxury brands ‘show’ and don’t ‘tell’ in their communications. They build highly evocative brand worlds to reinforce their core brand meaning – with minimal mention of features or benefits.

Take LVMH. In 2007, it ran a campaign shot by the celebrity photographer Annie Leibovitz featuring historical, cultural and sports icons, including Mikhail Gorbachev, Catherine Deneuve, Sean Connery, Keith Richards, Francis Ford Coppola, Buzz Aldrin, Diego Maradona, Pelé and Zinedine Zidane, reflecting on what travel meant to them. In 2014, it opened a €790 million art museum and cultural centre in Paris called Louis Vuitton Foundation, designed by the ‘starchitect’ Frank Gehry. It is currently showing one of the biggest retrospectives of Mark Rothko ever staged. Luxury marketing on a different level.

3. Create halo products

Embody the brand’s essence in a flagship product that bathes the whole portfolio in its halo.

Luxury brands embody the essence of their brand meaning in one or two hero products, such as the Porsche 911 or the IWC Portugieser. These feature heavily in communications and take pride of place in their retail stores. Often bought by a select few, they may not even make much of a return, but they lift the value to the rest of the portfolio – where the real money is made.

To position themselves clearly from the outset, new luxury brands usually launch with their halo product. Then, tier down the price brackets with later releases. When new or old, luxury brands tend to curate relatively small portfolios of classic products that they refresh with occasional updates and special editions.

In France, the luxury sector sometimes uses the concept of the ‘Griffe’ to denote the pinnacle of a luxury brand. These products are at least presented to be touched by the brand creator, and while desired by all, can only be consumed by the elite few.

Giorgio Armani, one of the richest men in Italy, works this model astutely. While the 89-year-old still signs-off every design, he is hands-on with the design of his signature Giorgio Armani haute couture collection. He makes his real money through his diffusion lines of Emporio Armani and Armani Exchange brands. Ralph Lauren structures its business in a similar and even more profitable way. His one-off pieces are sold under Ralph Lauren, and then he tiers down through Polo and Lauren to price-friendly Chaps.

4. Craft flawless and distinctive objects

Create beautiful products from the highest-quality materials

Luxury brands differentiate their products through materials and craftsmanship. They use high-quality materials, often supported by a provenance story that adds romance about where those materials come from. While few luxury products are fully handmade, most have some handcrafted elements. Many brands will also offer some level of customisation of their high-end products. Crafted elements of products are often emphasised in communications and by retail staff in the connoisseurship stories they tell.

Few brands can make Hermès’ claim to have been ‘contemporary artisans since 1837’ and that it takes an artisan 48 hours to make a single Birkin bag. B&O get close for a tech brand, with its Craft stories that underline its commitment to ‘Superior craft since 1925’ in aluminium, fabric and wood.

5. Launch with panache

Create a buzz with invite-only events in high-cachet locations that reinforce the brand story

Most luxury brands outside fashion launch products infrequently, but aim to make a splash when they do. Prime venues and glittering guest lists are critical to the mix. As well as nurturing relationships with key customers, the primary aim is to gain coverage by the right kind of press and influencers. For example, even if the primary target consumers are in Asia, brands will often precede launches in Asia with events in Europe, aiming for coverage in Italian Vogue, Monocle or the FT’s How to Spend It.

Few can match the coups LVMH regularly pulls off, such as the Men’s Spring-Summer 2024 Show by Pharrell Williams last summer, which was held on Paris’ historic Pont Neuf bridge with Rihanna and Kim Kardashian on the guest list and closed with a concert by Jay-Z.

6. Distribute globally but selectively

Project prestige in international luxury centres and control scarcity through exclusive stores

Luxury brands have a global presence, but in global cities and billionaire playgrounds through their own, or carefully selected, independent stores – but increasingly not through upmarket department stores, which are in decline. Store location is not just about being in the right city but also about being in the right neighbourhood, on the right road, and in the right place on that road – ideally near brands of a similar ilk. Staff are highly trained in product knowledge, customer service, and relationship management.

Luxury brands are also highly selective about online channels, often limiting sales to their own branded websites and select few online retailers, such as Net a Porter or Mr Porter, who offer a high-quality user experience and customer service, as well as controlled pricing to avoid overt discounting, which tend to dilute brand prestige.

Retail is also pivotal in managing (or at least the perception) scarcity, a critical component of luxury lust. Access to limited editions and releases is offered to valued customers through invite-only events or by-appointment-only showings – and often managed through waiting lists. Hermès’ management of access to its iconic Birkin bag is the quintessential exemplar of this tactic.

7. Orchestrate the brand context

Associate with like-minded brands to strengthen positioning and reach new markets

Luxury brands are known by their associates. They carefully consider which events they sponsor, which brands to partner with, where they place their shops and advertising, and which PR firms, photographers and models to work with. All should add to a lucid brand world, elaborating on the brand’s essence.

Brand collaborations have become a popular way of widening and deepening the web of associations around a brand. These associations can include celebrities or influencers, artists or designers, and adjacent or same-category product brands.

In 2019, B&O and the luxury luggage brand Rimowa launched limited-edition Beoplay H9i headphones packaged in a signature RIMOWA aluminium case. The collaboration concept was to ‘celebrate the unique link between sound and travel’. Both brands emphasised their shared appreciation for aluminium, and partnered with Swedish composer and record producer Ludwig Göransso to produce a short campaign film. As well as reinforcing the sheer class of the equipment and its container, the collaboration also enabled each company to reach the other brand’s customers.

8. Package the aura

Reinforce the brand essence and exceptional product quality throughout the packaging experience

Luxury brands encapsulate their prestige and essence in their packaging. Particularly in categories like watches and jewellery, they invest in exquisite packaging that enhances the allure of the brand and the perceived quality of the product. The packaging also serves a significant functional role in categories highly reliant on gifting, especially in Asia, heightening the unwrapping experience. Luxury consumers own many watches and jewellery items – which spend most of their lives stored in their boxes in a safe. Legend has it that a big chunk of Vertu phones, which were often bought as gifts, were never activated and presumably sat in safes next to boxes of jewellery and watches.

High-quality packaging that stands the test of time underlines the ‘it’s not a purchase, it’s an investment’ mantra many luxury consumers whisper to themselves. The Swiss watch brand, Patek Philippe, embodies this attitude with its ‘Begin your own tradition’ and ‘You never actually own a Patek Philippe. You merely look after it for the next generation.’ tagline. When opened the packaging displays the product in a way that enhances its preciousness. The box also stores certificates of authenticity, guarantee certificates and other paperwork that adds value to the product as a heirloom (or for resale).

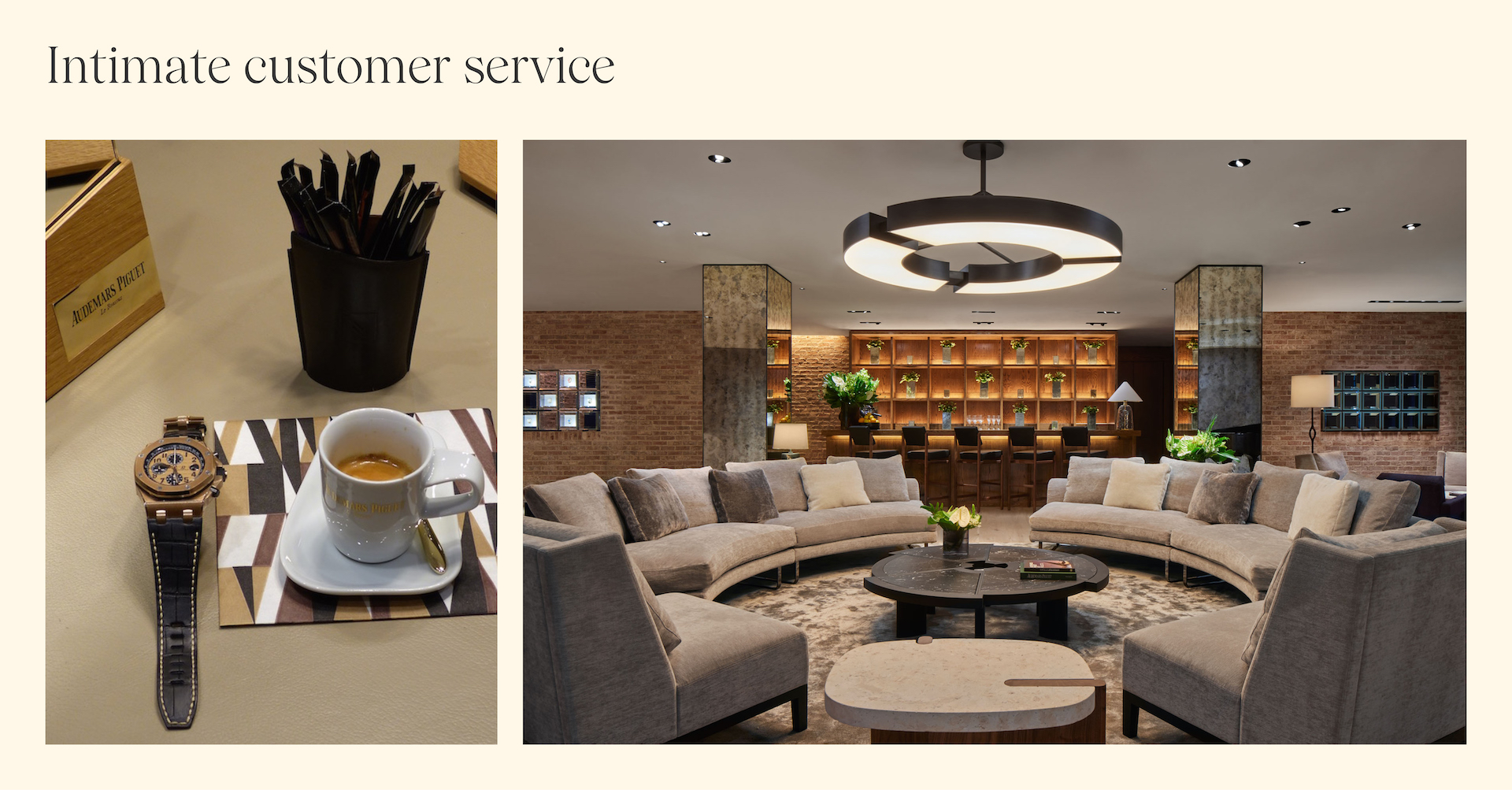

9. Care for every customer

Invest in an intimate understanding and service of customers

Luxury brands take customer service very seriously. Retail staff are trained to develop personal relationships with regular customers over years – often, over generations. They are regularly invited to events or by-appointment-only showings to make them feel like luxury insiders. Staff don’t follow scripts, instead they go the extra mile to meet their customers’ needs. More recently, brands have developed incredibly granular Customer Relationship Management systems to help them scale their ability to gather and act on customer insights. The purpose of these databases is always to empower a more tailored human interaction. As opposed to mass and premium brands that are doing all they can to automate customer service. In an age of AI, quality human interactions will underline a luxury experience.

Audemars Piguet, the Swiss luxury watch brand best known for the highly sought-after Royal Oak ( average price $55,000), is known for its customer attention. In 2023, it launched a new service in response to a luxury watch-related crime wave, it will guarantee to replace, refund or repair any stolen or damaged watch bought in 2022 or 2023 for two years.

The line between luxury and premium is sometimes blurred, Apple has certainly shown how premium brands can play by many of the nine Rules outlined above. But the Rules remain a good framework for success when crafting a luxury proposition for your category, consumer and context.

That said, a final watch out. Entering the luxury sector from below is tough. There is something like a law of gravity when it comes to market tiering strategy. It’s so much easier to tier downmarket than to trade up. From Armani Exchange to B&O Play, luxury brands leverage their prestige to offer access to their lustre at lower price points. But it’s much tougher to move in the opposite direction and convince consumers to pay a luxury premium for a brand they are used to looking down on. That’s why Nokia created the luxury mobile phone category with a separate Vertu brand, why Toyota traded up from mass to premium with Lexus, and why Nestle went upmarket under the Nespresso brand. Each company created separate business units and cultures from the core business to better focus on the distinct demands of the premium or luxury tier they entered.

This brings us back to the exception of Apple. While it is more of a mass premium brand, it exhibits many luxury traits – including its retail, communications and emphasis on crafting products from quality materials. From the mid-1990s, when it was a commodity personal computer brand on the edge of bankruptcy, it has managed to trade up to the edge of luxury – all under one master brand. It’s done this by executing its own take on these rules – but at a mass-market scale.

The luxury market has unique dynamics, consumer expectations, and competitive codes. Entering it requires a very thoughtful and deliberate approach. So, tread carefully, plan decisively, and definitely don’t treat your luxury market entry strategy as an extension of your business as usual.

Act like a prestige player.